We could easily create a list of 7-15 of the best banks for digital nomads but we’re keeping this post short, sweet, and to the point. In our honest opinion, there is one bank that outperforms all the other banks for digital nomads, and it’s Wise.

In the post, we’ll explain the pros and cons of using Wise, what we use it for, and why we believe they’re the future of banking for digital nomads.

We’ve been with Wise for a few years now and couldn’t be happier with them. We’ve lived through the days of Paypal ripping us off left right and center. No more of those 5-8% fees (we’re not kidding). Thankfully, Paypal no longer runs the online banking game and now companies like Wise are the new kids on the block.

Disclosure: This post contains affiliate links which means that if you decide to use them we get a small commission from the platform at no additional cost to you. All opinions are our own honest opinions and are not influenced by external sources. Thank you!

What is Wise and why are they the best digital nomad bank?

Wise, formerly known as Transferwise is an electronic money account. The money you have with Wise is safeguarded which means Wise holds the money and doesn’t loan out the money like a regular bank. There are pros and cons of that but for digital nomads and our lifestyle, it is the safer option.

We don’t want to bore you with all the details so let’s dive right into the pros and cons of Wise from a digital nomad perspective.

Get paid in over 10 currencies on Wise

We believe the most important thing when looking for a digital nomad bank is in what currencies you can be paid in. When they support your currency, then you can say goodbye to fees! If they don’t support your currency then it’s almost pointless to use them.

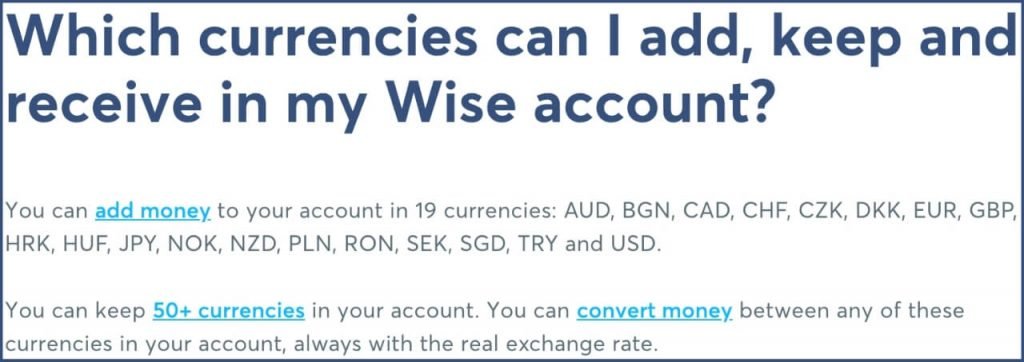

The good thing about Wise is they support incoming payments from 10 different currencies and growing all the time. The British Pound, United States Dollar, and The Euro are all on that list which makes up a big percentage of how digital nomads are paid.

Wise fees are some of the lowest

The most important thing after seeing if you can actually receive money from your customer or employer is to look at the fee that Wise charges.

Wise uses the mid-market rate which is constantly changing every 24-48 hours.

How it works is the more you send, the more you will pay on fees. This is based on percentage. We’ve found out that of all the digital nomad banks we’ve explored, Wise has some of the lowest fees in the game (if not the lowest).

You can check out the Wise exchange calculator here to test it out even before making an account. It breaks down how much you’ll pay in fees based on the currencies you use and the amount of money you send.

Spending money with a Wise card

This is one of the other features that we absolutely love about Wise. You can use the Wise card around the world with low conversion fees and, best of all, no transaction fees. Pretty awesome!

Basically, that means you don’t have to send your money from Wise to your local bank account and pay fees on that. If you want, you can leave the money in Wise and use your physical Wise card around the world.

Not having to transfer money to your bank account saves you time and money. Both of those are important to busy digital nomads.

It really seems too good to be true but it’s about time companies like Wise have come out to compete with companies like Paypal.

Pros and cons of using Wise as your digital nomad bank

Pros:

- You can send money cheaper and easier than old school platforms

- There are no hidden fees

- Payments can be made in 10 currencies

- It works in over 200 different countries

- You can spend in local currencies with your card

- Freeze and unfreeze your card whenever you want

- They have good support in multiple languages

Cons:

- You don’t make interest holding your money in Wise

- You can’t take out loans or overdraft

- The card option only works for residents of certain countries (see list here)

All in all, we think the pros outweigh the cons a million to one. As digital nomads, we personally think this is the best bank for digital nomads because of how transparent they. Everything Wise offers is so much more focused on the user (you and us) that the old school companies just don’t.

If you want to survive in this industry you have to get with the times and that’s what Wise has done. So hats off to them. We’ve been super happy with them for the past two years and are not planning on switching away anytime soon.

Other related questions to digital nomad banks

What is the best digital bank?

When it comes to multiple currencies, fast transactions, and cheapest fees then it has to be Wise that is the best digital bank. Other digital banks like Payoneer and Revolut are also good options. In our experience though Wise has always been the most reliable with the best perks.

Is Wise good for converting currencies?

Wise has some of the lowest fees when it comes to transferring and exchanging between currencies. If you’re a digital nomad and for example get paid in USD but live in Europe and need Euro the fees are very small.

Wise has always strived to be a digital nomad bank with low fees and they continue to deliver. If it’s low fees that you’re looking for than Wise is a good option.

You may also like…

- 19 Amazing Digital Nomad Cities Around the World

- 8 Places to get a Digital Nomad Visa – What You Need to Know

- 11 Exciting Digital Nomad Jobs You Can Do in 2022

- Wise Signup Link

Sum up the best bank for digital nomads

One day this may change, but for now Wise is really a step ahead of the rest. Especially for remote workers, digital nomads, and people who travel a lot and use different currencies. The headache of dealing with all these international fees goes away.

If you want to sign up and save money on your first transaction you use this Wise sign up link. If you have any questions about Wise, you can DM us on instagram or leave a comment below and we’ll get back to you right away.

We hope this was helpful to you, fellow nomads. Banking doesn’t have to be stressful and overwhelming. Once you have a bank and platform where you can get paid, transfer money, and spend money all in one it gets a lot easier!

Have fun!

Love it? Share it!